4 Trends Every Real Estate Investor Should Know

The real estate market is still strong and investors are confident. We’ve compiled four emerging trends that you should look out for.

Home prices continue to rise across the country during a period of unprecedented appreciation. There’s no question about it, the market is hot. More investors are getting involved in real estate and those already involved are doubling down. Based on investor activity, there’s reason to believe that this will continue.

These trends can help you inform your investing decisions moving forward.

1. Investor activity speaks to the strength of the market

An increase in investor activity always speaks to investor sentiment about upside in the market. The more activity, the more money investors anticipate they will make. Demand for homes has been outpacing the supply of homes. Plus, the gap between household formations and new home deliveries continues to grow. A share of multi-family permits filed is growing relative to single-family permits. This means that single-family homes are going to be a much sought after property type for the foreseeable future.

2. The Relationship between investor demand and home prices

Not all investor demand impacts home prices. Historically, home prices have gone up when demand came from foreign investors. These investors were looking to diversify with U.S. real estate, which drove prices up. Foreigners buying U.S. homes greatly exacerbated the affordability issue prior to 2018. Areas that struggled to deliver new homes were impacted most. By some estimates from NBER, zip codes with higher saturations of foreign buyers appreciated 8% more from 2012 to 2018 than other areas.

A big difference between domestic and foreign investors is where they get their deals. Foreign investors work with real estate agents to buy properties on the Multiple Listing Service (MLS). In contrast, domestic investors buy properties primarily off-market.

The increase in investor purchases today is coming from domestic investors. Therefore, they aren’t competing with home buyers who are looking for move-in ready properties. Instead, they are competing with other investors, who are looking to either rehab a property and put it back on the market, or turn it into a rental.

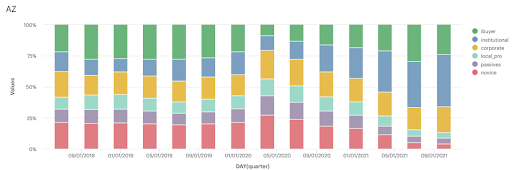

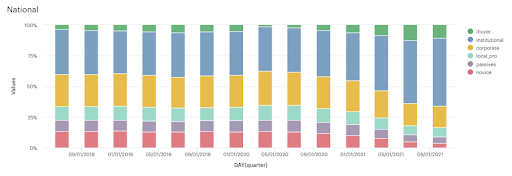

3. A Breakdown of investors by category

There are a variety of investors in the market. We track investor activity across multiple segments to see which are most active. Here’s how we categorize investors:

- Novices: less than 2 property purchases/year

- Passives / part-timers: 2 to 4 purchases/year

- Local pros: 5 to 12 purchases/year

- Corporate investors: 13 to 50 purchases/year

- Institutional investors: over 100 purchases/year

- iBuyers: encroach on the investor space with over 100 purchases/year

The mix varies by market, by state and on the national level. For example, Arizona, which has newer homes is a hotbed for institutional investors and iBuyers. There are fewer fix and flip opportunities though, so iBuyers and single family operators made up over 65% of investor activity.

Nevada, on the other hand, has an older housing stock. As such, it presents more fix and flip opportunities for local professionals and smaller corporate investors.

On the national level, it’s noticeable that institutional investors are creating more competition and larger barriers to entry for newer investors. Local pros share of the market made up 10.9% of all investor purchases in 2Q of 2019, and it made up just 7.3% in 2Q of 2021.

4. Investor strategies

With the supply chain disruptions and material shortages, definitely don’t see any tear downs. Different investors have different strategies. The savvier local pros are not afraid to go all in on a rehab opportunity with a quick turnaround. Sometimes we see properties cleaned, painted, landscaped and re-listed within a few days. A lot of the fix and flip investors appeared to have been cautious prior to the end of the foreclosure moratorium. They were unsure how it might impact the market, getting in and out quickly.

We’re also seeing more and more investors turning flips into rentals. With recent double-digit rent hikes, we anticipate that to be a continuing trend.

Looking ahead

It’s always important to use trends to stay ahead of the curve. This will give you an upper hand on the competition by understanding activity across various markets. As you begin to explore your next investment opportunity, be sure to consider these trends.

Discover nationwide properties you won’t find elsewhere

Find, win, and close on exclusive and vetted investment properties.