Creative Real Estate Investors Win Big

Looking at real estate investments from multiple angles can be the difference between winning and losing. Creative investors have the upper-hand on Sundae’s marketplace.

Real estate investors across the country use Sundae’s marketplace to scope out potential deals. Some prefer a specific house type. Others fancy a particular exit strategy.

Those who approach investing this way are overlooking opportunities with potential upside. To separate yourself from the pack, you need to think creatively about each deal. This article shows you insights from our marketplace that can help you zig when others zag. It’s time to think outside the box.

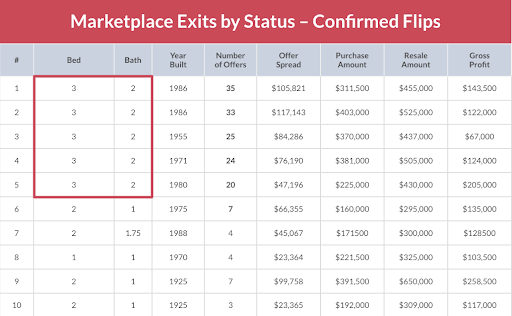

“Easy” flips receive the most offers

It’s important to understand that flippers value houses differently based on a variety of circumstances. For instance, certain types of properties get more offers than others: 3 bedroom, 2 bathroom houses are by far the most popular. Another group that receives more offers, those that can be easily converted into a 3 bed, 2 bath setup.

There are a few reasons for this, but chief among them is that this type of house is the most popular — in 2020 a 3 bed, 2 bath was the typical property type according to the National Association of Realtors. Popular houses are easy to resell after a flip, and they are easier to rent, as well. Much of their appeal lies in their flexibility in that the third bedroom could work as a guest room, an office, or a child’s bedroom.

Sundae has found that most investor activity is around what investors see as “easy flips.” Investors can get in, get out, and make a profit — quickly. In doing so, investors may be overlooking potential deals elsewhere.

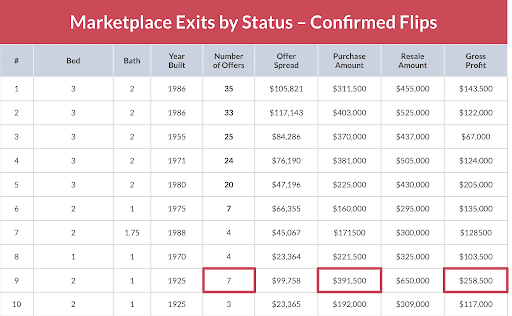

Unique properties offer high upside

Alternatively, houses that are in some way unique or have intricate layouts get fewer offers. These property types require more work and serve as a deterrent to many investors because they tend to have less interest from buyers. It’s harder to flip and resell a unique property without changing the floor plan or making other changes that appeal to buyers. Transforming a unique property into something desirable can pay huge dividends.

An amazing example of a unique deal turned profitable can be seen in row nine above. There were only seven offers on this 2 bed, 1 bath house built in 1925. Upon purchasing the property, the investor performed a full remodel. He turned it into a 2 bedroom with a den/office. He also added an accessory dwelling unit (ADU) in the backyard. This served as a studio, which included a kitchenette and bathroom. In the end, it sold for $650,000 and led to a gross profit of $258,500.

Some investors saw this house as a 2 bed, 1 bath house with limited potential. The creative investor on the other hand, viewed this as an opportunity to force appreciation through value adds. Another advantage this investor had was limited competition. By seeing what others didn’t, he was able to make this unique property into a desirable (and profitable) one.

Think outside the box with these 3 strategies

Real estate investors should always consider multiple exit strategies for the properties they’re considering. Your exit strategy should be based on the house itself, the local real estate market and the overall economic stability of the area. Here are some common exit strategies:

Clean and list

This straightforward strategy is simply cleaning up the house and then re-listing it for sale. It’s the fastest way to make money and get a quick turnaround. Sometimes it’s the right option. The updates in this scenario might include the following: light landscaping/outdoor cleanup, interior painting or touch-up painting, leave existing or new flooring, power washing, replace missing light bulbs and switch plates, and steam-cleaning any carpets.

Update

Make cosmetic updates to the property — which might take a few weeks up to a month — and then re-list for sale. The updates or small renovations in this scenario might include exterior and/or interior painting (including trim), light bathroom and kitchen updates, painting cabinets or vanities, countertop updates if needed, full landscaping, and plumbing and electric fixture updates if needed.

Remodel

This renovation strategy takes the longest as it may include knocking down walls and making major updates and repairs before putting it back on the market. The renovations in this scenario might include major systems remodel (heating, AC, etc.), update to floor plan, potential addition, roof replacement, full kitchen and bathroom remodels, and new flooring throughout.

Getting your hands on a property is the first step in a winning real estate investment strategy. Investors need to explore all three options because each is effective. In certain situations one strategy will be successful while the others might not make sense (or money). By looking at a property through multiple lenses, it gives investors more exit options.

Creative investors win big

Get an inside look at ways creative investors are winning on Sundae’s marketplace. Sundae’s lead economist Polina Ryshakov and CEO Josh Stech talk in-depth about their favorite deals and how to think outside the box. Watch the “Win Bigger” webinar to get important marketplace insights and learn how to employ winning investment strategies to grow your business.

Discover nationwide properties you won’t find elsewhere

Find, win, and close on exclusive and vetted investment properties.