SFR Operators are Paying Close Attention to Rental Demographics

SFR investors across the country are shifting their focus to two major demographics: Baby Boomers and Millennials.

Single family rental (SFR) investors from across the country are congregating in Scottsdale, Arizona to share key industry insights. IMN’s 9th annual Single Family Rental Investment Conference will discuss topics ranging from financing and flipping to the larger economic trends driving change.

One hot topic that investors are paying attention to is how demographics impact housing, particularly, the demand for SFRs. Baby Boomers and Millennials make up the two largest generations on record. Their preferences and demand for SFRs will play a huge role in the future of investing.

SFRs are viable options for many Baby Boomers and Millennials adjusting their housing needs. Each generation has shown an appetite for SFRs. On one hand, aging Baby Boomers are looking to downsize. Meanwhile, Millennials entering the housing market face fierce competition in this red-hot seller’s market.

Upon further investigation, our research suggests that one has a greater appetite for SFRs than the other. In this article, you’ll learn how to use this trend to inform your investing strategy.

Baby Boomers

The share of recent buyers who are 60 years and older grew 47% from 2009 to 2019. This is getting expedited further with COVID-19 spurring early retirements, de-urbanization, and other factors.

Sundae tracks reasons why people are selling their homes in the 23 markets we are in. Most people in that retirement or pre-retirement age are looking to batten down the hatches. In other words, they are factoring in affordability and the cost of living.

As they approach retirement, they know that their monthly income is about to be substantially reduced. Some Baby Boomers are looking to buy something in a cheaper market. Sun belt and western cities like Las Vegas, Tampa and Phoenix are seeing the largest share of mortgage purchase requests by Baby Boomers. These are places where a dollar goes a lot further on housing and other goods. Many are also downsizing. They aren’t looking for 3 bedroom homes, but smaller properties with less maintenance (and presumably lower prices than bigger houses). Others looking to spend more time with family or for financial reasons are moving in with their children.

Millennials

During the pandemic, people weren’t going out as much. Certain income levels also received stimulus checks. Perhaps the biggest influence on Millennials entering the housing market are affordable monthly payments.

Now, Millennials account for 37% of homebuyers and over 50% of new mortgages.

With the Fed’s efforts to stimulate the economy by lowering the discount rate, we are seeing a shift. We’re seeing historically low interest rates, which has incentivized Millennials to pounce. All of a sudden many more Millennials were able to afford houses at these lower interest rates because of its impact on monthly mortgage payments.

It turns out, they wanted to live in a house and they wanted to raise their family in the suburbs all along. SFRs are a good solution for the Millennials who are being priced out of the home buying market. Their appetite is primarily 3 bedroom homes that give them spatial flexibility. They want a bedroom for kids and an office for remote work.

What does this mean for SFR Operators?

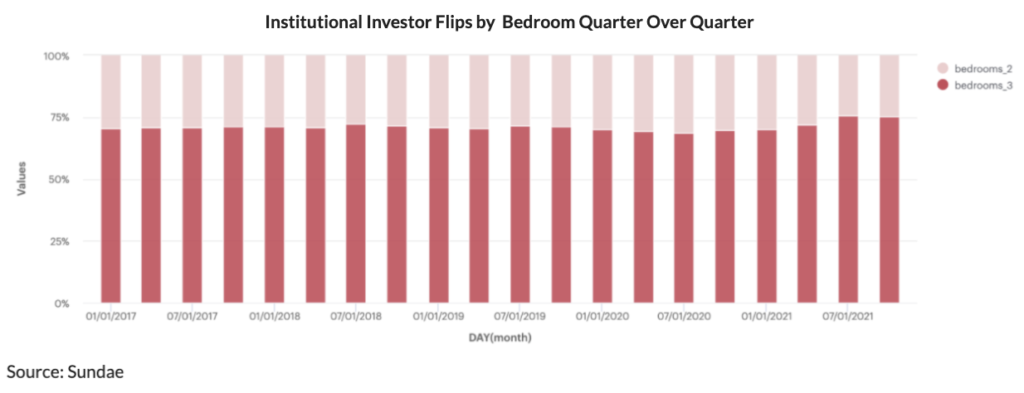

As an SFR operator, it’s important to take tenant preferences into consideration. Most of the underwriting criteria we are seeing from SFR operators includes both 3 bedroom and 2 bedroom homes. In fact, 75% of their purchases were 3 bedroom homes compared to 70% a year ago and in 2019.

It’s an interesting trend, considering right now investors are probably buying up anything and everything they can. SFR operators are likely seeing more demand from Millennials than the 55 and over demographic. There is also a possibility of some macroeconomic undercurrents.

Millennials are a less risky demographic to bet on right now. There are 2 very important factors to speak to that:

Employment

Where we have seen a lot of earlier retirements and younger boomers aren’t going back part-time being part of a cohort more susceptible to covid risks. At the same time, Millennials are staying employed or leaving to find higher paying jobs.

Inflation

Inflation is putting a higher pressure on wages. Demographic cohorts that are holding assets or earning wages and holding assets like real estate or stocks are better protected. Those nearing retirement have a larger part of their portfolio in mutual funds and are actually at a disadvantage. They will become more sensitive to potential rent increases.

Trends to watch

Rents always catch up to prices in terms of monthly payment increases. In markets with acute housing supply shortages, SFR operators are competing with first-time home buyers for properties. They’ve been very good at crafting a story of providing an affordable housing solution and filling the need. How long will this remain?

Discover nationwide properties you won’t find elsewhere

Find, win, and close on exclusive and vetted investment properties.